HITS Act Passes: What It Means for Independent Artists and Labels

The Help Independent Tracks Succeed (HITS) Act has officially been signed into law. This federal legislation introduces a tax provision allowing music creators to deduct up to $150,000 in qualified recording expenses in the same year those costs are incurred.

What the Law Changes

Prior to this law, most recording expenses such as studio time, session players, engineering, and other production costs had to be amortized over several years. The HITS Act updates this by offering an option for immediate deduction of those costs, similar to existing provisions available to film, television, and theater productions.

The law applies to albums, EPs, singles, and other qualifying music projects. The goal is to improve cash flow and ease the tax burden for creators who invest heavily in the recording process.

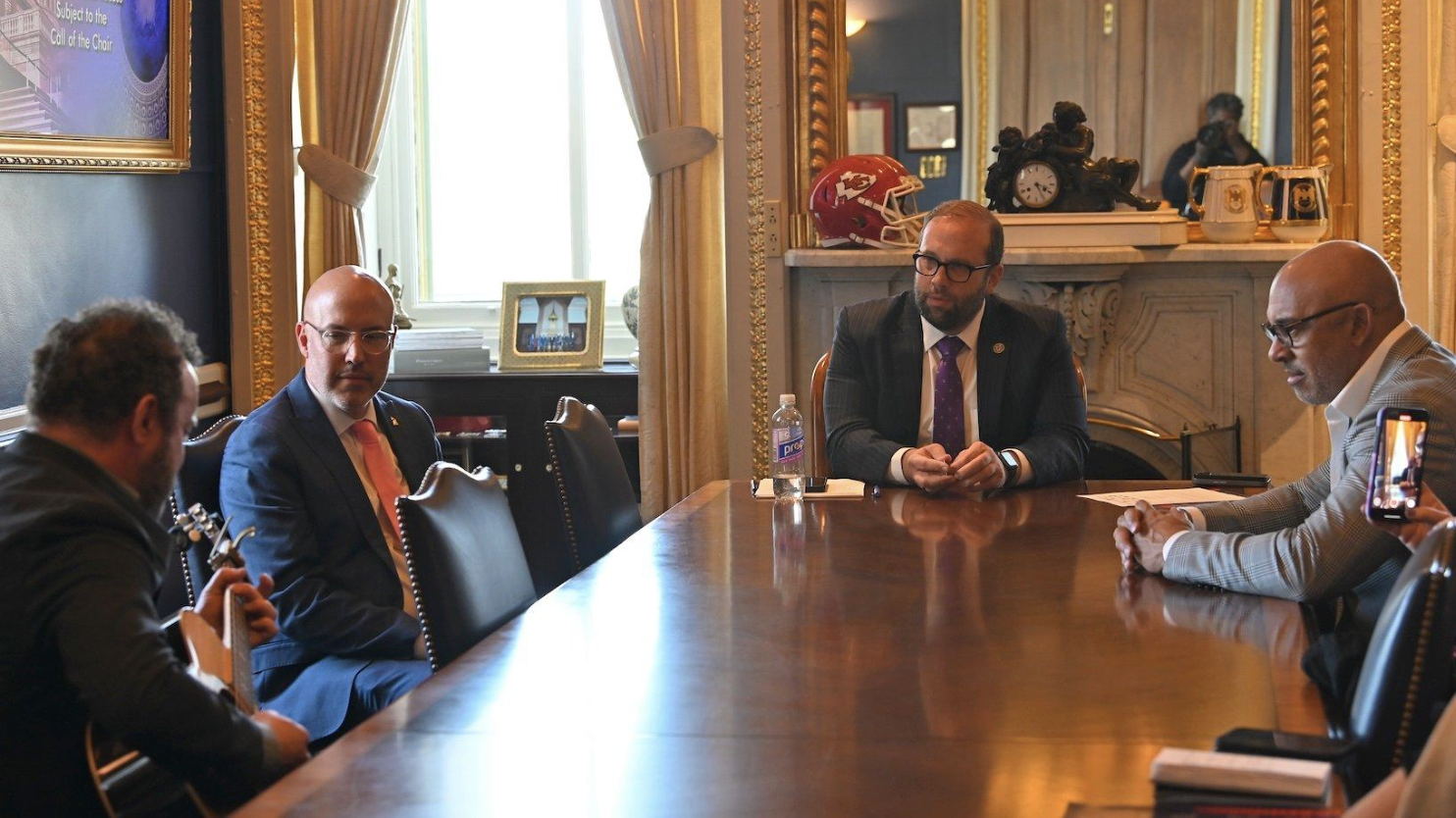

Photo Credit: Shannon Finney/Getty Images

Scope and Limitations

While the policy change is being celebrated as a step forward for the independent music sector, its impact will vary widely depending on the scale of an artist’s operations. To benefit from the full deduction, recording budgets would need to approach or exceed tens of thousands of dollars. For many small-scale or self-funded artists, the financial effect may be minimal or negligible.

The deduction is capped at $150,000 and is subject to IRS rules, meaning not all expenses will automatically qualify. For this reason, tax professionals are recommending that artists and labels evaluate the specifics with an accountant familiar with entertainment tax codes.

Additional Provisions

The HITS Act also includes a separate provision preventing a federal restriction that would have blocked states from introducing their own AI-related regulations. This maintains state-level control over issues tied to the use of likeness, voice, and other creator rights in emerging AI platforms.

What This Means for Music Professionals

The HITS Act introduces a new financial tool for creators operating at higher production budgets. It may be most relevant to independent labels, producers, and artists who are already investing significant amounts into their recording work.

For artists working with smaller teams or limited budgets, the effect of the law may be minimal. However, it does represent a structural update to how music is treated within federal tax policy, aligning it more closely with other creative industries.

This post is for informational purposes only and does not constitute legal or tax advice. Please consult a qualified tax professional for guidance related to your individual circumstances.

Let’s Collaborate!

Need help building the tone for your production? Hit us up – the Rareform Audio team would love to help you create the perfect soundtrack that speaks to your audience and enhances the power of your visual storytelling to new heights!

A weekly glimpse into the world of music & media with insider news, sync licensing opportunities, creative insight, and discussions.

Rareform Highlights

Black Sheep Music & Rareform Audio join forces with A24.

Join our Spotify Playlist and vibe with us! Featuring an array of tunes our team has been listening to.

Rareform Audio, an innovative leader in music and audio post-production, specializes in custom music creation, sound design, sonic branding and a vast catalog of diverse genres. Our talented roster of artists, composers and sound designers elevate projects for film, TV, ads, trailers and video games by merging artistry with cutting-edge soundscapes.